We specialize in health coverage benefits for all stages of life

Medicare Advantage

A Medicare Advantage plan, often referred to as "Part C" of Medicare, is a type of health insurance plan offered by private insurance companies that provide coverage for individuals eligible for Medicare, which is a federal health insurance program primarily for people aged 65 and older, as well as some younger individuals with certain disabilities. Here's an explanation of what a Medicare Advantage plan is and how it works.

1. Private Insurance Coverage

Medicare Advantage plans are offered by private insurance companies approved by Medicare. These plans are an alternative to Original Medicare, which includes Part A (hospital insurance) and Part B (medical insurance) coverage provided directly by the federal government.

2. All-in-One Coverage

Medicare Advantage plans combine the benefits of Original Medicare (Part A and Part B) into a single plan. In addition to these basic Medicare benefits, many Medicare Advantage plans offer extra coverage, such as prescription drug coverage (Part D), dental, vision, hearing, and wellness programs.

3. Network Based

Medicare Advantage plans often have networks of healthcare providers, such as doctors and hospitals, with whom they have negotiated contracts. Some plans require you to use these network providers to receive full benefits, while others may offer out-of-network coverage at a higher cost.

4. Cost Structure

Medicare Advantage plans typically involve cost-sharing arrangements, including premiums, deductibles, copayments, and coinsurance. The specific costs and coverage details can vary widely among plans, so it's essential to carefully review plan documents.

5. Annual Enrollment

Medicare beneficiaries can typically enroll in or switch Medicare Advantage plans during the Medicare Annual Enrollment Period (AEP), which usually occurs from October 15 to December 7 each year. There are also other enrollment periods, such as Special Enrollment Periods (SEPs), for those who qualify due to specific life events.

6. Additional Benefits

Medicare beneficiaries can typically enroll in or switch Medicare Advantage plans during the Medicare Annual Enrollment Period (AEP), which usually occurs from October 15 to December 7 each year. There are also other enrollment periods, such as Special Enrollment Periods (SEPs), for those who qualify due to specific life events.

7. Prescription Drug Coverage

Many Medicare Advantage plans include prescription drug coverage, known as Medicare Part D. This can help beneficiaries manage their medication costs by providing access to a formulary (list of covered drugs) with copayments or coinsurance for prescription medications.

8. Managed Care

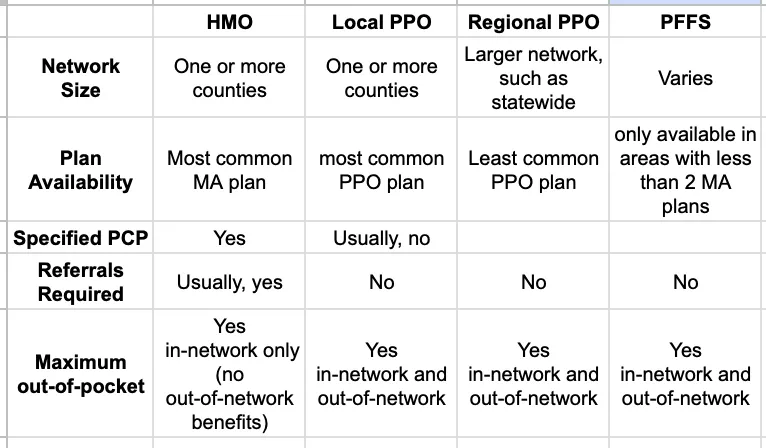

Some Medicare Advantage plans operate under managed care models, such as Health Maintenance Organizations (HMOs) or Preferred Provider Organizations (PPOs). These models may require beneficiaries to select a primary care physician and obtain referrals for specialist care.

9. Annual Review

It's crucial for Medicare beneficiaries with Medicare Advantage plans to review their plan's details annually during the AEP to ensure it still meets their healthcare needs. Plan options, costs, and coverage can change from year to year.

10. Special Needs Plan

Some Medicare Advantage plans are designed specifically for individuals with certain chronic conditions or low income, known as Special Needs Plans (SNPs). These plans may offer tailored benefits and care coordination.

Summary

A Medicare Advantage plan is a private insurance alternative to Original Medicare, offering comprehensive healthcare coverage with additional benefits. Beneficiaries should carefully compare plan options, costs, and network providers to choose a plan that suits their healthcare needs and budget. It's also advisable to consult with a Medicare specialist or use the official MedicareFull Width resources to make informed decisions regarding Medicare Advantage enrollment.

Costs vary county to county for each plan type.

Enter information below to find out what plans are available in your area.

Medicare Advantage Networks

Annual Election Period

(AEP)

October 15th

To

December 7th

During the AEP you can enroll in, change, or drop Medicare Advantage and Part D plans.

SecureVistas Insurance Group represents Medicare Advantage HMO, PPO, PFFS, and Prescription Drug Plan organizations that have a Medicare contract. Enrollment depends on the plan’s contract renewal. Not all plans offer all of these benefits. Benefits may vary by carrier and location. Limitations and exclusions may apply. Every year, Medicare evaluates plans based on a 5-star rating system. Part B Premium give-back is not available with all plans. Availability varies by carrier and location. Actual Part B premium reduction could be lower. Deductibles, copays and coinsurance may apply. SecureVistas Insurance Group is a non-government website and is not endorsed by the Centers for Medicare and Medicaid Services (CMS), the Department of Health and Human Services (DHHS) or any other government agency.

We do not offer every plan available in your area. Currently we represent 6 organizations which offer 41 products in our area. Please contact Medicare.gov, 1-800-MEDICARE, or your local State Health Insurance Program (SHIP) to get information on all of your options

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov

or 1–800–MEDICARE (TTY users should call 1-877-486-2048) 24 hours a day/7 days a week to get information on all of your options.

To send a complaint to Medicare, call 1-800-MEDICARE (TTY users should call 1- 877-486-2048), 24 hours a day/7 days a week). If your complaint involves a broker or agent, be sure to include the name of the person when filing your grievance.