Medicare Explained

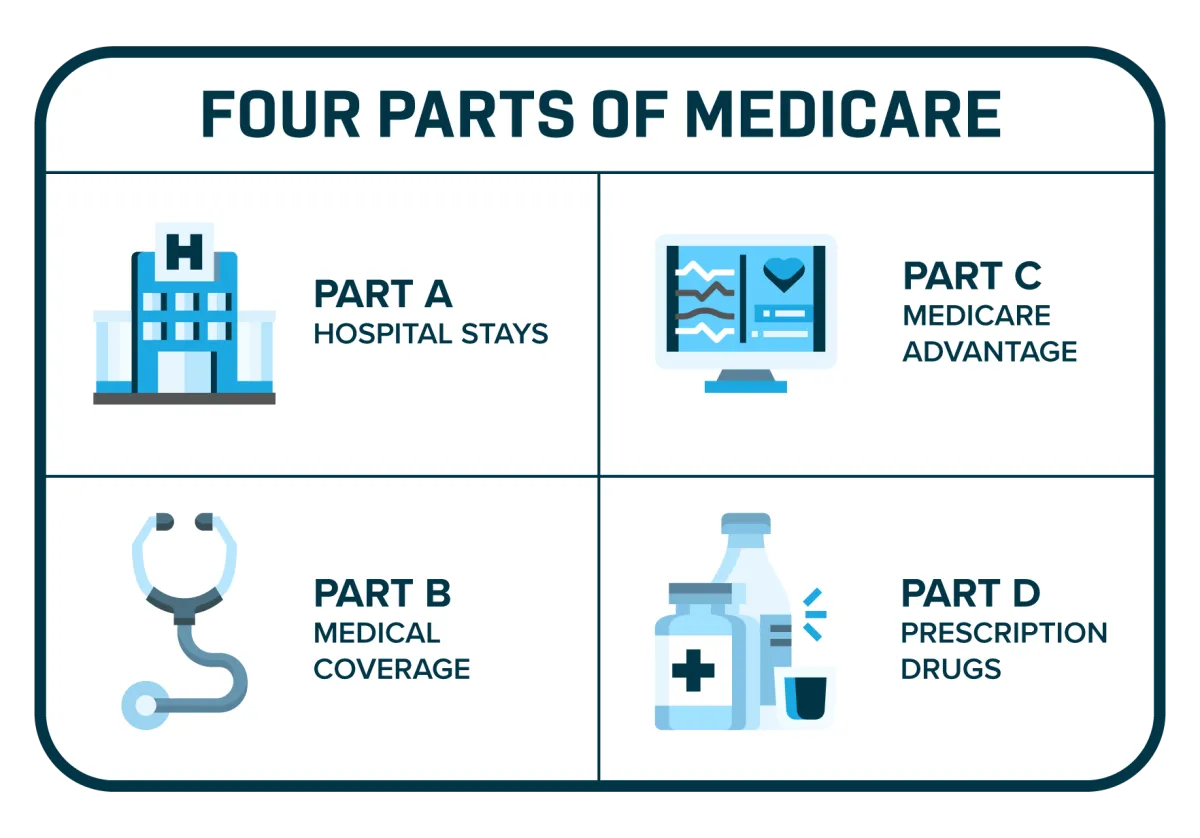

Original Medicare is the United States’ federal health insurance program for people who are 65 or older. It is also available for certain people younger than 65 with disabilities or people with End-Stage Renal Disease. There are several parts to Medicare that contain different coverage.

What is Part A?

Medicare Part A covers inpatient hospital care, skilled nursing, hospice, surgery, and home healthcare. Deductibles and cost-sharing will apply. Most folks will not have to pay Part A premiums.

What is Part B?

Medicare Part B covers doctor visits, preventative, outpatient services, and lab tests. Deductible and cost-share will apply. Part A and B comprise what is known as “original medicare.”

What is Part C?

Part C, also known as Medicare Advantage, takes the original medicare and privatizes it. In other words, a Medicare Advantage plan bundles Part A, Part B, and usually Part D into one single comprehensive plan with a private carrier.

What is Part D?

Medicare Part D is also known as prescription drug coverage. Part D coverage is available as a Stand Alone Option (PDP) or as part of a Medicare Advantage plan (Part C). Part D plans are offered by private insurance companies contracted and approved by Medicare.

Don't Risk Getting the Wrong Coverage

I'm here for you!

I understand the Medicare enrollment process can be difficult to understand. This is why I strive to educate and empower our clients to make the best decisions for their health insurance coverage..

What are Medicare Supplements?

Medicare Supplement plans, also called Medigap, are designed to work with Original Medicare Parts A and B. Medigap policies help pay for some health care costs not covered by Original Medicare, such as deductibles, coinsurance and foreign travel emergency.

These plans are offered by private insurance companies and are available to people with Medicare Part A and B. People with Original Medicare and a Medicare supplement can choose any stand-alone Part D prescription plans to pay for their drugs. People who are enrolled in Medicare Advantage plans (Part C) are not eligible for a Medicare Supplement insurance policy.

SecureVistas Insurance Group represents Medicare Advantage HMO, PPO, PFFS, and Prescription Drug Plan organizations that have a Medicare contract. Enrollment depends on the plan’s contract renewal. Not all plans offer all of these benefits. Benefits may vary by carrier and location. Limitations and exclusions may apply. Every year, Medicare evaluates plans based on a 5-star rating system. Part B Premium give-back is not available with all plans. Availability varies by carrier and location. Actual Part B premium reduction could be lower. Deductibles, copays and coinsurance may apply. SecureVistas Insurance Group is a non-government website and is not endorsed by the Centers for Medicare and Medicaid Services (CMS), the Department of Health and Human Services (DHHS) or any other government agency.

We do not offer every plan available in your area. Currently we represent 6 organizations which offer 41 products in our area. Please contact Medicare.gov, 1-800-MEDICARE, or your local State Health Insurance Program (SHIP) to get information on all of your options

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov

or 1–800–MEDICARE (TTY users should call 1-877-486-2048) 24 hours a day/7 days a week to get information on all of your options.

To send a complaint to Medicare, call 1-800-MEDICARE (TTY users should call 1- 877-486-2048), 24 hours a day/7 days a week). If your complaint involves a broker or agent, be sure to include the name of the person when filing your grievance.