Social Security

Optimization Analysis

Why Social Security Optimization Matters

Social Security is a critical component of retirement planning for most Americans. It provides a financial safety net that can significantly impact your retirement lifestyle. However, navigating the complexities of the Social Security system to maximize your benefits can be challenging. That's where I come in.

Why Social Security Optimization Matters

Social Security optimization involves a comprehensive analysis of your unique financial situation to determine the best strategy for claiming your Social Security benefits. This analysis considers various factors, such as your age, marital status, work history, life expectancy, pensions and retirement goals. The goal is to help you make choices that will:

Maximize Lifetime Benefits

My analysis aims to help you understand how to get the most out of your Social Security by considering when and how to claim your benefits.

Ensure Financial Security

I take into account your overall financial picture to ensure that your Social Security strategy aligns with your broader retirement goals.

Minimize Tax Implications

Social Security benefits can be subject to taxes. I'll help you optimize your strategy to potentially reduce your tax liability.

Adapt to Life Changes

Life is unpredictable. My analysis helps you adapt your Social Security strategy in the face of unforeseen circumstances like health issues or changes in marital status.

How my Social Security Optimization Analysis Works

Personalized Assessment

I start by gathering information about your unique situation, including your Social Security statement which can be downloaded off the ssa.gov website. In addition we look at your marital status.

Comprehensive Analysis

As an experienced financial expert I utilize cutting-edge tools and software to analyze your data. I'll run various scenarios to determine the optimal claiming strategy for you.

Customized Recommendations

Based on the analysis, I provide you with a detailed report outlining personalized recommendations. This includes information on when to claim your benefits, how to maximize spousal benefits, and strategies to minimize taxes.

Ongoing Support

My commitment to you doesn't stop with the report. I'm here to answer your questions, provide clarification, and help you implement your chosen strategy.

Social Security Roadmap sample

The following are screenshots of an 18-20 page Roadmap report provided to you

Table of contents

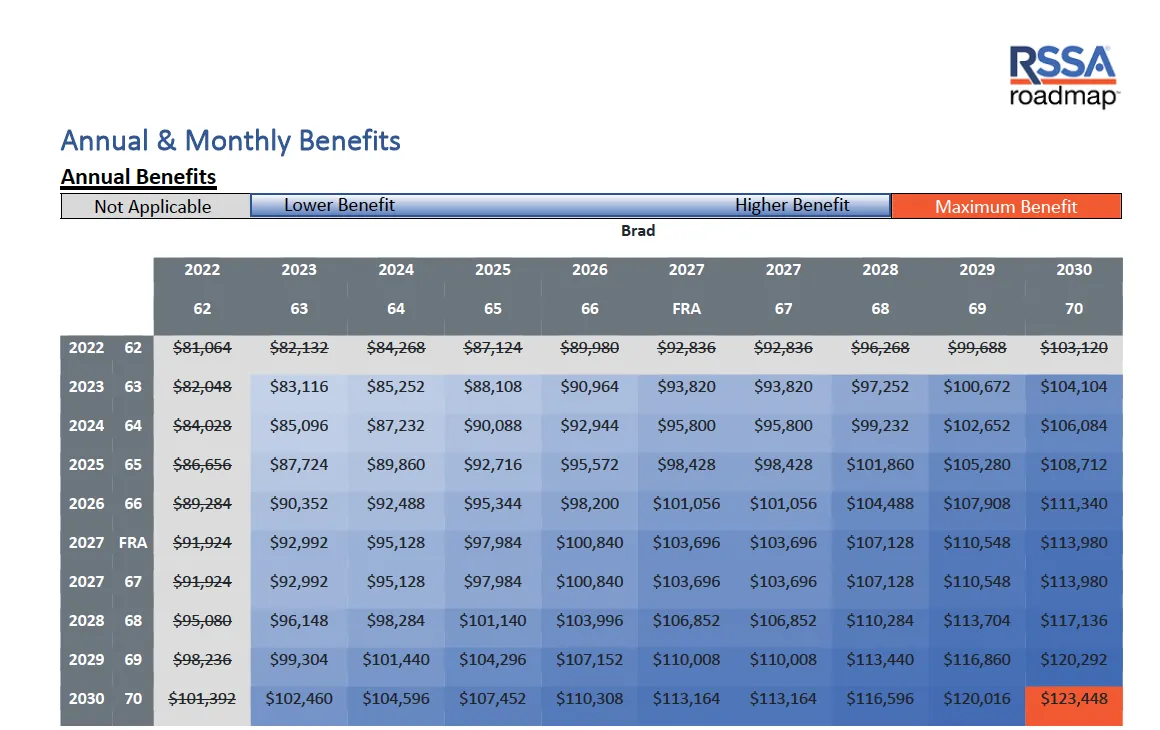

Benefits "heat map"

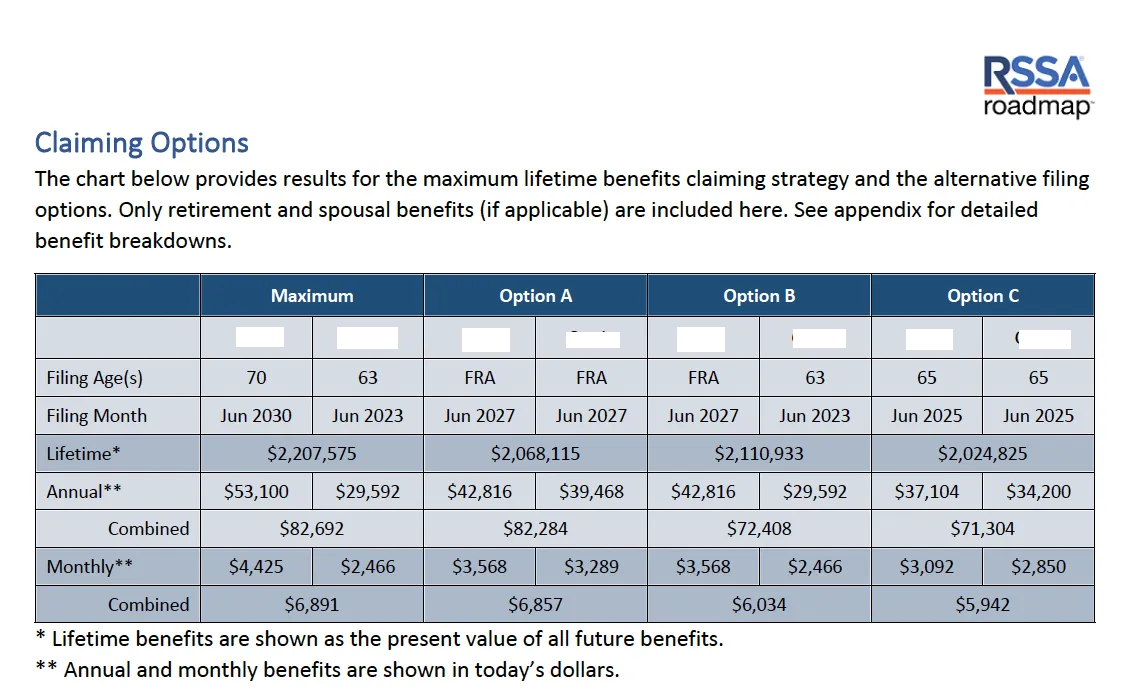

Claiming options

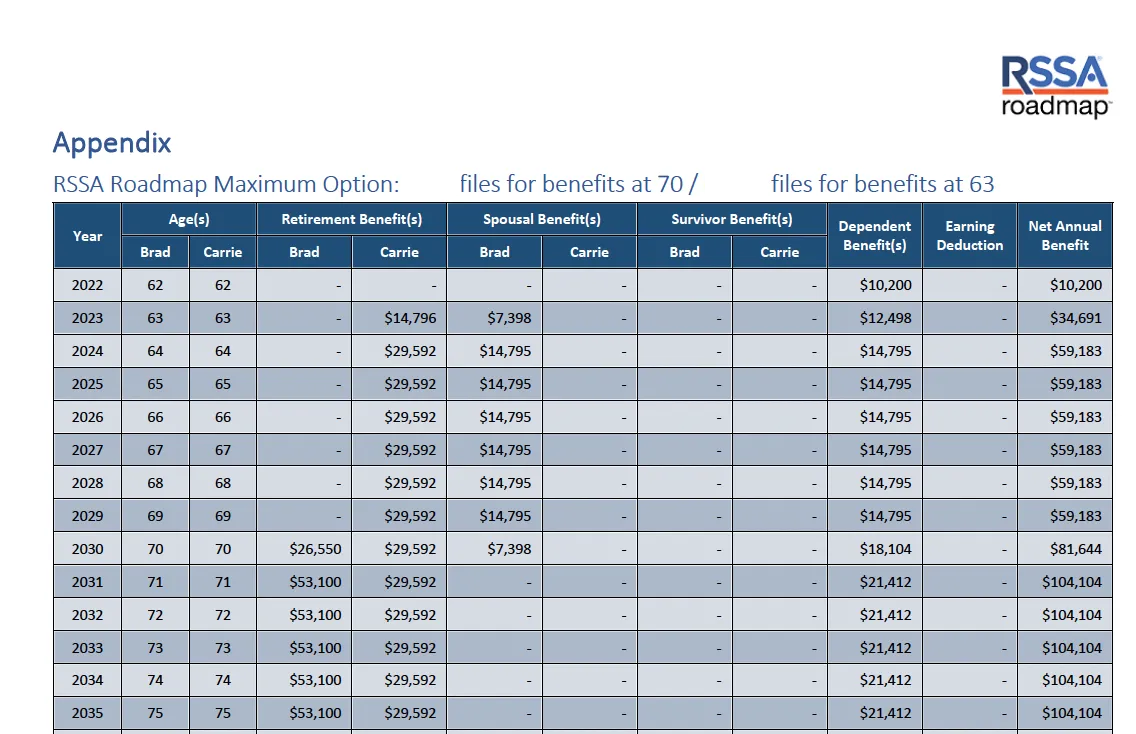

Year by year claiming options

Eric Sorensen - Registered Social Security Analyst

SecureVistas Insurance Group represents Medicare Advantage HMO, PPO, PFFS, and Prescription Drug Plan organizations that have a Medicare contract. Enrollment depends on the plan’s contract renewal. Not all plans offer all of these benefits. Benefits may vary by carrier and location. Limitations and exclusions may apply. Every year, Medicare evaluates plans based on a 5-star rating system. Part B Premium give-back is not available with all plans. Availability varies by carrier and location. Actual Part B premium reduction could be lower. Deductibles, copays and coinsurance may apply. SecureVistas Insurance Group is a non-government website and is not endorsed by the Centers for Medicare and Medicaid Services (CMS), the Department of Health and Human Services (DHHS) or any other government agency.

We do not offer every plan available in your area. Currently we represent 6 organizations which offer 41 products in our area. Please contact Medicare.gov, 1-800-MEDICARE, or your local State Health Insurance Program (SHIP) to get information on all of your options

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov

or 1–800–MEDICARE (TTY users should call 1-877-486-2048) 24 hours a day/7 days a week to get information on all of your options.

To send a complaint to Medicare, call 1-800-MEDICARE (TTY users should call 1- 877-486-2048), 24 hours a day/7 days a week). If your complaint involves a broker or agent, be sure to include the name of the person when filing your grievance.